Happy Bitcoin Pizza Day, everybody!

. . . You do know about Bitcoin Pizza Day, don't you? On May 22, 2010, Laszlo Hanyecz, a programmer from Florida, paid 10,000 bitcoins for two Papa John's pizzas—the first recorded bitcoin transaction in history. Now, May 22 is observed in the crypto community as "Bitcoin Pizza Day" and is no doubt celebrated with many a pizza order.

At the time of Hanyecz' iconic pizza purchase, 10,000 bitcoins were valued at $41. Precisely 15 years later, on May 22, 2025, bitcoin hit an all-time record high valuation of nearly $112,000. That means that, in today's prices, Hanyecz paid over $1,000,000,000 for those two pizzas. I hope they tasted good.

So, are you looking at all of this Bitcoin Mania 2.0 (or is it 3.0?) and scratching your head in wonder? If so, welcome to the crypto party. You must be new here.

Dedicated Corbett Reporteers are, of course, not new here. They'll remember back in March of 2017, when the price of one bitcoin surpassed the price of one ounce of gold for the first time, prompting me to write "Bitcoin Over Gold: What Does It Mean?"

And they'll remember back in December of 2017, when bitcoin broke the $10,000 mark for the first time, prompting me to write "Bitcoin $10,000: What Does It Mean?"

Given that we're now past the $100,000 mark, I'd say it's time for an update to that article, wouldn't you?

So, without further ado, let's roll up our sleeves and get to work answering the question everyone is asking: what the hell is going on with bitcoin?

BITCOIN TO THE MOON?

If you haven't been keeping your eye on the crypto markets over the past few months, you've missed one hell of a wild ride.

We saw bitcoin rocket past the $100,000 mark for the first time last December on the back of Trump's "Crypto President" promises.

Then this past February there was a crypto crash in which bitcoin lost 20% of its value from its post-inauguration high, and a range of crypto assets, from Ethereum to XRP to Musk's beloved Dogecoin, lost more than 10% of their value in under 24 hours.

And, of course, who can forget the incredible highs and equally incredible lows of the Hawk Tuah meme coin saga?

But even if you're actively trying to avoid crypto news, you've doubtless seen this week's remarkable bitcoin price run play out in the headlines passing through the news wires.

First: "Bitcoin hits all-time high of $109,000 amid stock market recovery."

Then: "Bitcoin tops $111,000 for first time as US optimism lifts cryptocurrencies."

And now: "Bitcoin hits new record high near $112,000 as rally marches on."

This crypto mania has only emboldened the serial speculators of the professional pundit class who love to make eye-catching, attention-grabbing, click-baiting predictions for the benefit of their online media overlords.

Witness, for example, Bloomberg's David Pain, citing "bitcoin options traders" in a story about how bitcoin is heading to $300,000.

Not to be outdone, Forbes mined an even more sensational prognostication from Arthur Hayes, the CEO of crypto exchange BitMEX: "Bitcoin To $1 Million By 2028?" Stay tuned to Forbes to find out!

Although it might seem to the casual observer that this incredible price rise came out of nowhere, those who have been watching the crypto space know this journey past $100,000 has been a topsy-turvy saga that's been unfolding for the past half year. In fact, bitcoin has tested the $100,000 mark no less than four times in the past six months.

So clearly this latest round of Tulip Mania isn't just a passing fancy. Something is going on here to keep driving crypto prices in general—and bitcoin prices in particular—up. But what?

WHY IS THIS HAPPENING?

So, why is bitcoin skyrocketing? Well, according to one article on the recent record-breaking run, this rally is being "fueled by momentum and institutional support."

[sarcasm] Oh, of course! "Momentum." Yes, that's clearly part of what's going on here! And "institutional support." Well, I guess that explains it. Case closed! [/sarcasm]

Now, this sounds like the kind of blather that the financial "experts" come up with when they have absolutely no clue what's going on in the markets. However, whether they know it or not, these mainstream repeaters are actually correctly identifying the phenomenon (even if they can't explain its context).

As it turns out, there is an awful lot of "institutional support" fueling this rally. But what does that mean, exactly? Let's take a look.

The first sign that Trump's vow to be the first "crypto president" was more than mere campaign rhetoric came just three days into his administration, when he signed an executive order on "Strengthening American Leadership in Digital Financial Technology." The sweeping order made it an official policy of the Trump White House "to support the responsible growth and use of digital assets, blockchain technology, and related technologies."

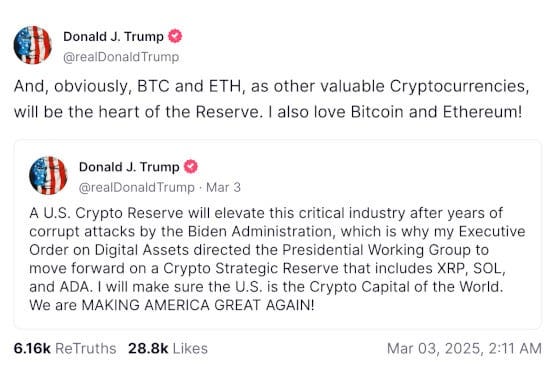

Trump followed up on this with a Truth Social post in March proclaiming the formation of a "US Crypto Reserve."

This led, predictably enough, to a surge in crypto prices that has ended up in this week's record-setting valuation.

But it isn't only the White House providing the "institutional support" fueling this bitcoin rally.

Now US Congress is getting in on the act, with the US Senate this week advancing the Guiding and Establishing National Innovation for U.S. Stablecoins (“GENIUS”) Act, a bill designed to create a legislative and regulatory framework for payment stablecoin issuers.

So is Abu Dhabi's sovereign wealth fund, which is making a $408 Million Investment In BlackRock’s Bitcoin ETF.

Even JPMorgan, whose CEO Jamie Dimon has long been a vocal crypto skeptic, is joining the party, with the bank announcing it's finally going to "allow" its clients to purchase bitcoin.

Not to be outdone, Goldman Sachs is backing Bitgo, a crypto custody firm that's "launching a Crypto-as-a-Service (CaaS) platform designed to help financial institutions integrate digital asset trading into their offerings."

And you'd better believe the broligarchs are buying a seat at the big boy's table, too, with Meta this month announcing that it's exploring the possibility of integrating stablecoin payments into its platforms.

For those who remember a decade ago, when governments and banks were all vehemently opposed to crypto (or completely dismissive of it), there can be no doubt that there has been a sea change in perception of the subject in the financial sector. Yes, of course central bankers are excited about Central Bank Digital Currencies, but it seems more and more elitist financial institutions and political oligarchs are behind crypto in general and bitcoin in particular. This is the "institutional support" that the MSM talking heads so rightly identify as the fuel for the current price rally.

. . . But that still leaves an unanswered question: Why? Why are all these banksters and politicians suddenly on board with crypto? What's the play here?

Goodbye Petrodollar, Hello Bitcoindollar!

Again, why are banks and politicians suddenly warming up to crypto?

Well, as with the JFK assassination or 9/11 or the toppling of the Syrian government or any other large-scale deep state event, there is not one single explanation for this crypto turnaround. There are many.

The most easily understood motive for the change of opinion on bitcoin among the oligarchs is money. After all, there's plenty of profit to be made by jumping on the crypto bandwagon right now.

Just ask Trump. It's not hard to see why he went from this:

To this:

. . . in just a few short years. Between his investments in the $TRUMP Memecoin, WLFI USD1 Stablecoin, and $WLFI Governance Token, it's now estimated that crypto-related investments account for $2.9 billion of his $7.7 billion fortune. In other words, crypto-dependent assets now make up 37% of his total net worth.

The banksters, too, realize there is plenty of money to be made mining these new markets.

Take BlackRock. Not only do they get to profit off of the ups and downs of the crypto market with their $71 billion iShares Bitcoin Trust ETF, they also get to participate in the next big financial scam that crypto enables: tokenization.

"Tokenization" is the act of turning real-world assets like stocks, bonds and real estate into digital tokens that can be traded online. And, just as collateralized debt obligations and mortgage-backed securities "revolutionized" finance by allowing Wall Street to bundle up toxic debt, slice the bundle into tranches and sell it back to investors as AAA-rated investments, so, too, will tokenization "revolutionize" trading by allowing companies like BlackRock to carve up assets into infinitely small slices and sell them to average investors. Not coincidentally, just as BlackRock CEO Larry Fink was there at the birth of the collateralized mortgage obligation market in the 1980s, so, too, is he leading the charge on tokenization, devoting a considerable chunk of his influential annual letter to shareholders to the subject. What could go wrong?

Yes, the profit possibilities from running pump-and-dump memecoin scams and from launching new digital finance companies and from running crypto-tied ETFs and from tokenizing real-world assets are responsible for a significant part of the run-up in "institutional support" for bitcoin and crypto in recent years. But it turns out there's an even deeper, more foundational reason for this surge in crypto support from the financiers: it's part of the planned changeover in the global monetary paradigm.

In case you hadn't noticed, the world is losing faith in the almighty dollar as the backbone of the global monetary system. Uncle Sam's $36 trillion debt is set to rise trillions of dollars higher if the "big, beautiful bill" currently snaking its way through the Senate actually passes, and the Fed is struggling to keep interest rates on that debt down. It seems inevitable at this point that the "unthinkable" will finally happen: the post-WWII Bretton Woods system—built on the concept of a gold-backed US dollar as the world reserve currency—and the post-Bretton Woods petrodollar system—built on the concept of worldwide demand for US dollar-denominated oil sales—will come crashing down unless some ingenious new scam can be engineered to keep people clamouring for dollars.

Enter "stablecoins." For those not in the know, "stablecoins" are digital crypto assets that are pegged 1:1 with a reference asset, most commonly the US dollar. Tether, for example, is a stablecoin that trades under the USDT currency code and purports to hold actual US dollars in reserve to back its cryptocurrency issuance. Thus, the price of Tether can always be kept at near-parity with the US dollar, providing a "stable" base for banks, traders and payment services to exchange money via a blockchain even when the prices of bitcoin and other crypto assets are fluctuating wildly.

As Mark Goodwin and Whitney Webb have been warning in their reporting on this subject for years now, though, stablecoins tied to the US dollar and woven into the global payment infrastructure could be a way for the globalist oligarchs to maintain US dollar hegemony during this perilous period of monetary paradigm transition. If banks, payment services, international traders and people in developing countries with inflation-prone currencies can be convinced to invest in stablecoins that are pegged to US dollars or US Treasuries, they will thereby be supporting the dollar. This is why so many politicians and financiers are excited about stablecoins in particular these days.

In fact, the potential for stablecoins to form the backbone of the global monetary order explains not just the crypto frenzy that is causing the current bitcoin price rally, it also explains why every government and every banking cartel and every multinational corporation is trying to get into the stablecoin scam right now.

This is why Trump's January executive order on crypto specifically stipulates that it is designed "to promote the development and growth of lawful and legitimate dollar-backed stablecoins worldwide."

This is why the US Senate is advancing the GENIUS Act.

This is why a consortium of some of the largest banks in the US are "exploring whether to team up to issue a joint stablecoin."

This is why European traders are wringing their hands over the EU's new stablecoin regulations.

And this is why the Chinese are now looking to issue their own yuan-based stablecoins in the near future.

WHAT DOES IT ALL MEAN?

Obviously, the subject of the changeover in the global monetary order and the role of stablecoins in that monetary order are incredibly important topics that deserve a much deeper exploration than I'm able to give here. (For more on that, please see the excellent reporting of Goodwin and Webb on the subject.)

But for our purposes today, we seem to have answered the question of the enigma of bitcoin's record-setting price rise. Crypto prices are rising in dollar terms because cryptocurrencies provide the financial oligarchs with a steady stream of profits and, even more importantly, with a base for building a new monetary order that they can use to continue to dominate, regulate and control society from behind the scenes.

But where does that leave us? What should the average non-globalist, non-technocrat be thinking with regard to the exploding crypto market?

Well, let's look back at what I wrote on this subject in my "Bitcoin Over Gold" editorial in March 2017:

So once again, it comes back to the basic philosophy behind the question of “value.” Are you interested in the value of gold and bitcoin as measured in US Federal Reserve notes? Are they each just another commodity to be used to turn a quick buck? If so, then by all means, study the charts, look for the patterns, find your opportunities and enjoy the game.

But what if the "value" of gold or bitcoin is not measured in government fiat, but in their own potential as monetary instruments? After all, the US dollar will not outlast the US government (in its current form, at any rate), but gold will and bitcoin might. And if these instruments are not investments but hedges, that changes the meaning of their "value," doesn't it?

And let's couple that with what I wrote in my "Bitcoin $10000" editorial in December 2017:

What matters is that the cryptocurrency idea will survive this period, whatever happens with the bitcoin bubble, just as the World Wide Web didn't go away when the dot-com bubble burst. Now you might love that fact or you might hate that fact, but it's a fact.

As with everything else, it's a question of what we do with this fact. Can a cryptocurrency that lives up to the "pirate money" ideal be created, or is the idea destined to be neutered, co-opted and wrestled back into the service of the banksters?

Now that is the question that matters. But that is a question for another day. In the meantime, better prepare some popcorn. This is going to be one hell of a ride.

It seems to me that those observations from eight years ago are as true today as they were when I first penned them. In fact, maybe they're even more relevant to us today than they were at the time.

Certainly, the fact that we're still talking about the price of bitcoin as measured in dollars shows that crypto has fundamentally failed to live up to the idea that was originally sold to the crypto-anarchists. Bitcoin, it seems, is not a currency designed to circumvent the dollar, but instead to underwrite its value. And given that the banksters are now scheming to build an international payment and settlement system using stablecoins that will be backed by dollars, we see that the promise of cryptocurrency—the promise of a truly peer-to-peer currency that circumvents the central banks altogether—has at long last been completely neutered and co-opted, as I warned those many years ago.

Perhaps the naysayers were right all along. Maybe "Satoshi Nakamoto" really was some NSA/CIA alphabet souper. Maybe bitcoin and all its cryptocurrency brethren were always intended to be the basis for a system of digital currency control. But then again, the naysayers who were saying this eight years ago were the same ones saying that bitcoin was a bubble that was going to burst within 18 months, so maybe we should take their fact-free pontifications with a grain (or a hefty serving) of salt.

Call me naïve, but I still believe that the idea of a decentralized, peer-to-peer, permissionless network for disintermediation of the monetary system is a useful idea. If the last decade has taught us anything, however, it's that we're not ready for such an idea. The number of freedom-loving people who see the utility of it and who actively work to bring it about has not reached whatever magic tipping-point number is necessary to bring it forward into reality. As a result, we're on the brink of a digital monetary tyranny that, far from freeing us from the banksters' clutches, is set to hardwire the central bankers' control into place.

Perhaps there's still hope. Maybe people will start exploring privacy-centered cryptocurrencies and forming agoristic trading networks that use those currencies as one of many different ways of transacting for the counter-economic goods and services they desire. Maybe eight years from now I'll be writing "Dollar 0.000000000001 Monero: What Does It Mean?"

Maybe.

All I can tell you for sure right now, though, is that I didn't celebrate Bitcoin Pizza Day this week.

Like this type of essay? Then you’ll love The Corbett Report Subscriber newsletter, which contains my weekly editorial as well as recommended reading, viewing and listening. If you’re a Corbett Report member, you can sign in to corbettreport.com and read the newsletter today.

Not a member yet? Sign up today to access the newsletter and support this work.

Are you already a member and don’t know how to sign in to the website? Contact me HERE and I’ll be happy to help you get logged in!