by James Corbett

corbettreport.com

November 12, 2022

Let's play a little game.

Let's imagine you're Joe Q. Normie and you need to run out for some groceries. You hop in the car and head to the store. What store do you go to? Why, Walmart, of course!

And, being an unwitting victim of the sugar conspiracy, what do you buy when you're there? Coke, naturally!

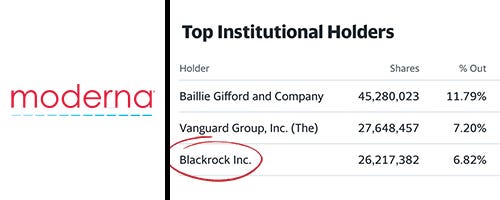

And you can get jabbed at Walmart these days, right? Well then, you might as well make sure you get your sixth Moderna booster while you're there!

And don't forget to fill up with gas on your way home!

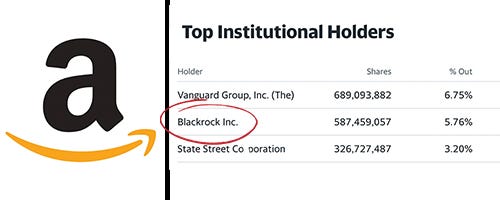

Is this creeping you out? Then why don't you shut yourself in your house and never go out shopping again? That'll show 'em! After all, you can always order whatever you need from Amazon, can't you?

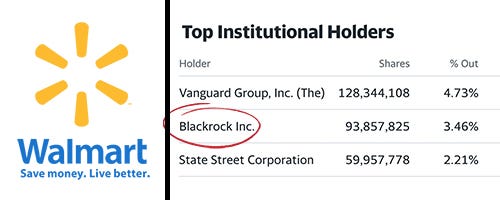

Are you noticing a pattern here? Yes, in case you haven't heard, BlackRock, Inc. is now officially everywhere. It owns everything.

Sadly for us, however, the creepy corporate claws of the BlackRock beast aren't content simply to clutch onto a near plurality of the shares of every major corporation in the world. No, BlackRock is now digging its talons in even further and flexing its muscles, putting that inconceivable wealth and influence to use by completely reordering the economy, creating scamdemics and shaping the course of civilization in the process.

Let's face it: if you're not concerned about the power BlackRock wields over the world by this point, then you're not paying attention.

But don't worry if all of this is news to you. Most people have no idea where this investment giant came from, how it clawed its way to the top of the Wall Street dogpile, or what it has planned for your future.

Let's fill that gap in public understanding. Over the course of this investigative series, you're going to get a crash course in the creepiest company you've never heard of.

This week I will give A Brief History of Blackrock and describe how it came to be the economic and political juggernaut it is today.

In Part 2 of this series, we will examine how BlackRock's Going Direct reset paved the way for the massive economic and monetary transition that we have just lived through under the cover of the scamdemic.

And in Part 3, we will examine the Aladdin system and the other creepy ways BlackRock is planning to use its power to mould society in its own interest.

*NOTE: This is Part 1 of the How BlackRock Conquered the World series.

Click here for Part 2: Going Direct.

Click here for Part 3: Aladdin’s Genie and the Future of the World.

PART 1: A BRIEF HISTORY OF BLACKROCK

"Hold on a second," I hear you interject. "I've got this! BlackRock was founded as a mergers and acquisitions firm in 1985 by a couple of ex-Lehmanites and has since gone on to become the world's largest alternative investment firm, right?"

Wrong. That's Blackstone Inc., currently headed by Stephen Schwarzman. But don't feel bad if you confuse the two. The Blackstone/BlackRock confusion was done on purpose.

In fact, BlackRock began in 1988 as a business proposal by investment banker Larry Fink and a gaggle of business partners. The appropriately named Fink had managed to lose $100 million in a single quarter in 1986 as a manager at First Boston investment bank by betting the wrong way on interest rates. Humbled by this humiliating setback (or so the story goes), Fink turned lemons into lemonade by crafting a vision for an investment firm with an emphasis on risk management. Never again would Larry Fink be caught off guard by a market downturn!

Fink assembled some partners and brought his proposal to Blackstone co-founders Pete Peterson and Stephen Schwarzman, who liked the idea so much that they agreed to extend Fink a $5 million line of credit in exchange for a 50% share in the business. Originally named Blackstone Financial Management, Fink's operation was turning a nice profit within months, had quadrupled the value of its assets in one year, and had grown the value of its portfolio under management to $17 billion by 1992.

Now firmly established as a viable business in its own right, Schwarzman and Fink began musing about spinning the firm off from Blackstone and taking it public. Schwarzman suggested giving the newly independent company a name with "black" in it as a nod to its Blackstone origins and Fink—taking roguish delight in the inevitable confusion and annoyance such a move would cause—proposed the name BlackRock, saying, "You know if we do something like this, all of our people will kill us."

The two evidently share the same sense of humour. "There is a little confusion [between the companies]," Schwarzman now concedes. "And every time that happens I get a real chuckle."

But a shared taste for causing unnecessary confusion was not enough to keep the partners together. By 1994, the two had fallen out over compensation for new hires (or perhaps due to distress over Schwarzman's ongoing divorce, depending who's telling the story), and Schwarzman sold Blackstone's holdings in BlackRock for a mere $240 million. ("That was certainly a heroic mistake," Schwarzman admits.)

Having made the split with Blackstone and established BlackRock as its own entity, Fink was firmly on the path that would lead to his company becoming the globe-bestriding financial colossus that it is today.

In 1999, with its assets under management standing at $165 billion, BlackRock went public on the New York Stock Exchange at $14 per share. Expanding its services into analytics and risk management with its proprietary Aladdin enterprise investment system (more on which in Part 3 of this series), the firm acquired mutual fund company State Street Research & Management in 2004, merged with Merrill Lynch Investment Managers (MLIM) in 2006, and bought Seattle-based Quellos Group's fund-of-hedge-funds business in 2007, bringing the total value of assets under BlackRock management to over $1 trillion.

But it was the Global Financial Crisis of 2007—2008 that catapulted BlackRock to its current position of financial dominance. Just ask Heike Buchter, the German correspondent who literally wrote the book on BlackRock. "Prior to the financial crisis I was not even familiar with the name. But in the years after the Lehman [Brothers] collapse [in 2008], BlackRock appeared everywhere. Everywhere!" Buchter told German news outlet DW in 2015.

Even before the Bear Sterns fiasco materialized into the Lehman Brothers collapse and the full-on financial bloodbath of September 2008, Wall Street was collectively turning to BlackRock for help. AIG, Lehman Brothers, Fannie Mae, and Freddie Mac had all hired the firm to comb through their spiraling mess of credit obligations in the months before the meltdown. BlackRock was perceived to be the only firm that could sort through the dizzying math behind the complicated debt swaps and exotic financial instruments underlying the tottering financial system, and many Wall Street kingpins had Fink on speed dial as panic began to grip the markets.

"I think of it like Ghostbusters: When you have a problem, who you gonna call? BlackRock!" UBS managing director Terrence Keely told CNN at the time.

And why wouldn't they trust Fink to pick through the mess of the subprime mortgage meltdown? After all, he was the one who helped launch the whole toxic subprime mortgage industry in the first place.

Oh, did I forget to mention that? Remember the whole "losing his job because he lost $100 million for First Boston in 1986" thing? That came just three years after Fink had made billions for the bank's customers by constructing his first Collateralized Mortgage Obligation (CMO) and almost single-handedly creating the subprime mortgage market that would fail so spectacularly in 2008.

So, depending how you look at it, Fink was either the perfect guy to have in charge of sorting out the mess that his CMO monstrosity had created or the first fink who should have gone to jail for it. Guess which way the US government chose to see it?

Yes, you guessed right. They saw Fink as their saviour, of course.

Specifically, the US government turned to BlackRock for help, with beleaguered US Treasury Secretary Timothy Geithner personally consulting Larry Fink no less than 49 times over the course of the 18-month crisis. Lest there be any doubt who was calling the shots in that relationship, when Geithner was on the ropes and his position as Secretary of the Treasury was in jeopardy at the end of Obama's first term, Fink's name was on the short list of those who were being considered to replace him.

The Federal Reserve, too, put its faith in BlackRock, turning to the company for assistance in administering the 2008 bailouts. Ultimately, BlackRock ended up playing a role in the $30 billion financing of the sale of Bear Stearns to J.P. Morgan, the $180 billion bailout of AIG, and the $45 billion rescue of Citigroup.

When the dust finally settled on Wall Street after the Lehman Brothers collapse, there was little doubt who was sitting on top of the dust pile: BlackRock. The only question was how BlackRock would parley its growing wealth and financial clout into real-world political power.

For Fink, the answer was obvious: move from the petty crime of high finance into the criminal big leagues of government. Accordingly, throughout the last decade, he has spent his time building up BlackRock's political influence until it has become (as even Bloomberg admits) the de facto "fourth branch of government."

When BlackRock executives managed to get their hands on a confidential Federal Reserve PowerPoint presentation threatening to subject BlackRock to the same regulatory regime as the big banks, the Wall Street behemoth spent millions successfully lobbying the government to drop the proposal.

But lobbying the government is a roundabout way to get what you want. As any good financial guru will tell you, it's far more cost-efficient to make sure that no troublesome regulations are imposed in the first place. Perhaps that's why Fink has been collecting powerful politicians for years now, scooping them up as consultants, advisors and board members so that he can ensure BlackRock has a key agent at the heart of any important political event.

As William Engdahl details in his own exposé of BlackRock:

BlackRock founder and CEO Larry Fink is clearly interested in buying influence globally. He made former German CDU MP Friederich Merz head of BlackRock Germany when it looked as if he might succeed Chancellor Merkel, and former British Chancellor of Exchequer George Osborne as “political consultant.” Fink named former Hillary Clinton Chief of Staff Cheryl Mills to the BlackRock board when it seemed certain Hillary would soon be in the White House.

He has named former central bankers to his board and gone on to secure lucrative contracts with their former institutions. Stanley Fisher, former head of the Bank of Israel and also later Vice Chairman of the Federal Reserve, is now Senior Adviser at BlackRock. Philipp Hildebrand, former Swiss National Bank president, is vice chairman at BlackRock, where he oversees the BlackRock Investment Institute. Jean Boivin, the former deputy governor of the Bank of Canada, is the global head of research at BlackRock’s investment institute.

And it doesn't end there. When it came time for Biden's handlers to appoint the director of the National Economic Council—responsible for the coordination of policymaking on both domestic and international economic issues—naturally they turned to Brian Deese, the former global head of sustainable investing at BlackRock Inc.

Indeed, by 2019, BlackRock's ascension to the height of political power was complete. At the same time that the World Economic Forum was appointing Fink as a member of its Board of Trustees, then-presidential candidate Joe Biden was making the pilgrimage to Wall Street to beg for BlackRock's support in the fight against Trump. "I'm here to help," Fink reportedly assured Biden.

And the rest, as they say, is history.

. . . or, more accurately, is the present. Because when we peel back the layers of propaganda from the past three years, we find that the remarkable events of the scamdemic have absolutely nothing whatsoever to do with a virus. We are instead witnessing a changeover in the monetary and economic system that was conceived, proposed and then implemented by (you guessed it!) BlackRock.

And that, ladies and gentlemen, will be the focus of Part 2 of this exploration. Stay tuned! . . .